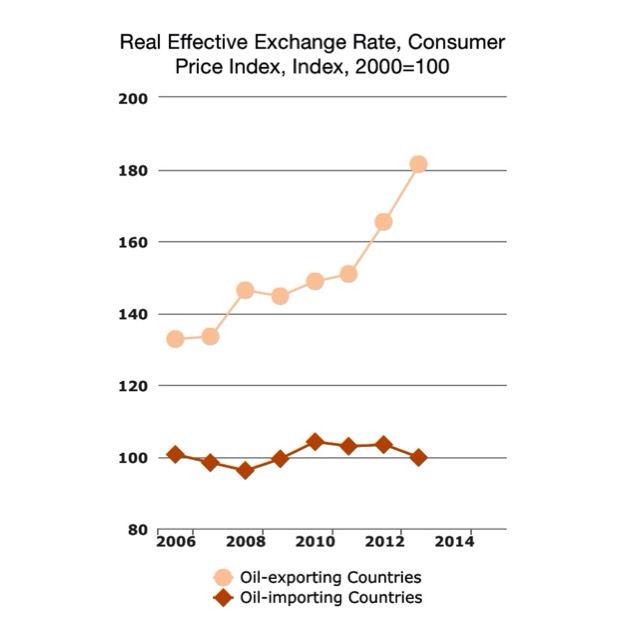

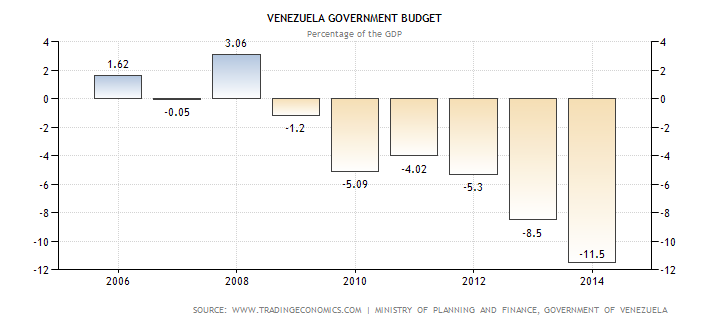

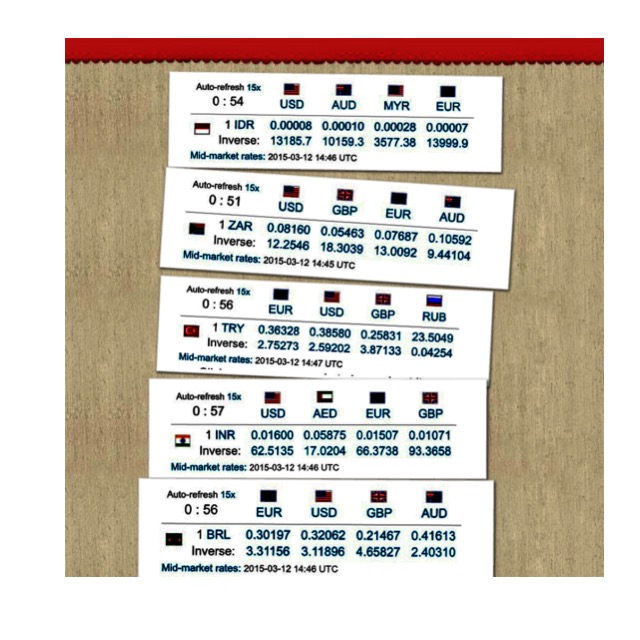

In 2014, global oil prices have fallen by nearly %50. In summary, world oil supply is expected to growing while world oil demand is falling this year. Falling oil prices is good news for oil importers, but it is bad news for oil exporters. Oil importers benefit from a falling oil price and this has led to decrease the current account deficit for oil importers. This is still useful, especially for Turkey and India which have large current account deficits and economies’ depend on foreign capital to fund its big deficit and imports. (Even though current account deficit has shrunk, foreign capital flow is weak to finance for these countries). However, for oil exporters, a falling oil price has caused lower trade surplus and government budget deficit. For example, Venezuela has heavily devaluated its exchange rate and forced to face high inflation and budget deficit compare to other oil exporting countries. Moreover, Russia lost about 2bn dollar in revenues for every dollar in the oil price and the ruble felt sharply. As a result, Russia has confirmed not to cut production because she did not want the importer countries to increase their production. On the other hand, for example, Saudi Arabia fixed the value in its currency immediately through foreign currency reserves. China’s situation is another story compare to other exporting countries.

China became the dominant source of growth in crude-oil demand in recent years and cheaper oil increases China’s private demand and the purchasing power of its consumers , but weakness in demand in emerging countries and Europe is bad for their trading partner China.

You must be logged in to post a comment.